“Sow a thought, reap an action; sow an action, reap a habit” – Steven Covey from “The 7 Habits of Highly Effective People” fame couldn’t have framed this better in the context of marketing for Financial Services. As financial marketers, you may be trying to acquire new customers or up-sell/cross-sell to existing customers via online and offline channels. In a traditional sense, selling in-person via the branch, agents, or wealth managers; increases the probability of selling your offerings, in comparison to selling via digital channels which is non-personal.

As a marketer, the fundamental challenge faced while trying to acquire prospects or engaging customers online is the fact that their experience is by no means personalized. In fact, how often can a financial marketer claim that they are engaging with a prospect/customer at a 1:1 level in real-time?

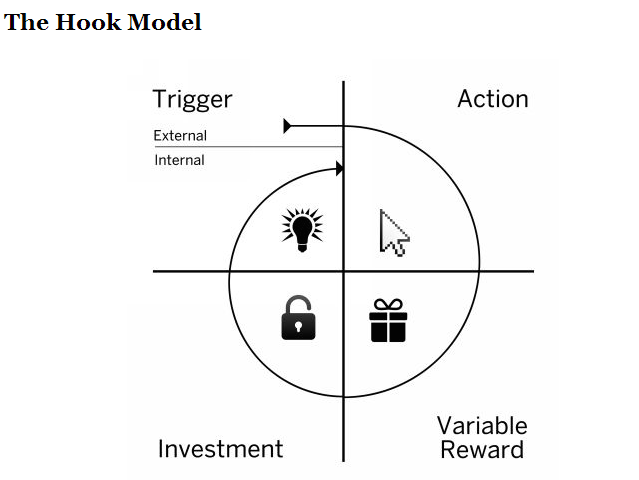

We live in a world where people’s attention span has dropped significantly and it’s very difficult to keep an individual “hooked” unless you have something interesting to keep them coming back. In the book “Hooked – How to build habit-forming products”, Nir Eyal, the author, introduces a concept called the “Hook Model”. The “Hook Model” is a model formulated by Nir in his pursuit to find the blueprints for forming habits. A financial marketer’s pursuit to acquire or engage customers can only fructify when they place hooks which build habit-forming behavior with financial services customers.

The Hook model is a four-phase process that companies use to form habits. This is how it would apply in the context of transforming marketing in Financial Services.

Image Credit: Nir Eyal

1. Trigger

The trigger is the spark that initiates the behavior from the consumer. There are two kinds of triggers from the context of financial services.

Internal – Customers coming back to the banking/insurance website by nature of being an account holder and do a select set of things

External – Prospects who come to the website by accident or because they see an offer. This could possibly be a chance visit and they may never come back.

Here are a couple of scenarios from the prospect and customer perspective:

Prospect

Mike, a prospect, may come to a banking site by accident as he was browsing for loans to purchase his dream home. Mike then drops off and may not come back to the website. However, if Mike were to allow the bank’s website to activate a browser push notification before he leaves, there is a way to get him back on the website.

Customer

Ann is a banking customer who has a credit card and very recently has been doing a lot of travel. She is looking for an upgrade in her card to get reward points on air miles and drops off. When Ann returns to the website she sees a custom banner with a credit card that gives her 4X rewards points for travel with lounge access.

2. Action

To trigger an interest is one thing. But to ensure the prospect/customer takes an action or have them behave in a certain way requires the effort to try and engage with them.

To see the above example through the Action phase:

Prospect

Mike has dropped off and sees a browser push notification catered to his last browsed product. After beckoning him back to the website, it’s possible to show Mike a custom page where he sees the banner personalized with the home loan offer and giving him the required information to entice him to click the link and learn more.

Customer

When Ann drops off the site, the bank sends her a text message telling her that she is eligible for a travel credit card upgrade and submits a link to get her approval to send her the card.

3. Variable Reward

The nature of the variable reward is how do you keep the person engaged constantly so as to ensure that the customer comes back to your website and knows that they can get an offer that interests them.

Looking at the same example through the Variable Reward phase:

Prospect

Mike gets a browser push notification for a home loan but is not enticed by the offer. A couple of days later he gets an offer where there is a reduced interest rate for the home loan and a waiver of the fee to get the loan along with an option foreclose the loan within 1 year of awaiting the loan. Mike is now enticed and more likely to click the link and sign up for the home loan.

Customer

Ann is invited to apply for a credit card but also gets an offer to apply for a forex card. From the bank’s CRM data, it is evident that Ann is a senior sales executive for an enterprise software company and she travels out of the country a couple of times a year based on the charges on her past credit card bills. So the bank is now able to upsell a product to Ann based on some of the data that they already have.

4. Investment

The last phase of the hook model is where the customer/prospect increases the probability of making another pass in the hook cycle when the bank is able to track all the steps that the customer/prospect followed in order to make the sale of the product.

Again when you look at this front with the context of the examples:

Prospect

Mike now clicks on the link and fills up the form and shares all the details about his loan and reveals more information about himself. The bank can now reach out to him for a home improvement loan and thereby have him hooked on to the bank.

Customer

After being offered a forex card. Ann is able to appreciate the fact that the bank is offering her products that are relevant to her current needs. So the next time the bank sends her a marketing offer, she is very likely to look at it more closely and take action.

Final Thoughts

What Financial marketers can interpret from the “Hook Model“ is that it is vital to establish a 1:1 experience for each customer to have them hooked to your brand and your offerings. Financial services companies need to invest in technologies that can bring together various data points about their prospects and customers and act on it in real-time. They will then have a greater likelihood of generating or building habits that become hard to displace for a prospect/customer and thereby transform marketing in the financial services world.

By Rahul Mathew | Vice President – Marketing & Strategic Partnerships at Lemnisk

Leave a Reply